Which is the Best Income-Driven Repayment Plan?

For many borrowers, the best income-driven repayment plan is the one with the lowest monthly loan payments. But with four different options, figuring out which has the lowest monthly payments can be challenging. Changes in income and marital status can affect the total cost of the loans, as can plans to enroll in graduate school.

Each borrower needs to evaluate each of the income-driven repayment plans based on their own specific circumstances. However, the following general rules apply to most borrowers.

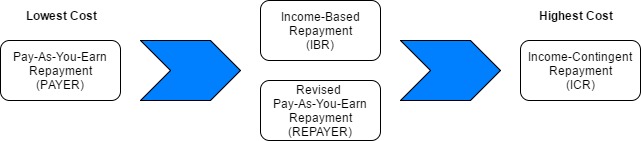

If the borrower qualifies for Pay-As-You-Earn (PAYE), they should choose that repayment plan, as it is the best of the four income-driven repayment plans. But, only borrowers who have no loans prior to October 1, 2007 and at least one loan disbursed on or after October 1, 2011 will qualify.

If the borrower does not qualify for PAYE, then either Income-Based Repayment (IBR) or Revised Pay-As-You-Earn (REPAYE) will yield lower total payments. Although the monthly payment is 15% of discretionary income under IBR and 10% under REPAYE, IBR caps the monthly payment at the standard repayment amount while REPAYE does not. REPAYE also has a marriage penalty.

REPAYE bases the monthly payments on the combined income of borrower and spouse, even if the couple files separate returns. Thus, if a borrower expects his or her income to increase or expects to get married, IBR usually will cost less than REPAYE. REPAYE also increases the repayment term from 20 to 25 years for borrowers who go to graduate or professional school, leading to a substantial increase in the total cost of the loan. Thus, for most borrowers, IBR should be preferred over REPAYE.

Income-Contingent Repayment (ICR) usually results in the highest monthly and total payments. If the borrower will be earning below 150% of the poverty line for most of their work-life, IBR, PAYE and REPAYE all yield a zero monthly loan payment. However, when the remaining debt is cancelled after 20 or 25 years in repayment, the cancelled debt will be treated as income to the borrower under current law.

So all three income-driven repayment plans have the same total cost for low-income borrowers. ICR, on the other hand, requires income to be below 100% of the poverty line for the monthly payment to be zero. ICR has another benefit, in that interest is no longer capitalized when it reaches 10% of the original loan balance. So, ICR might be slightly less expensive for low-income borrowers if their income is below 100% of the poverty line.

If the borrower qualifies for Public Service Loan Forgiveness (PSLF), the repayment term is cut to 10 years and the remaining debt is forgiven, tax-free. The same preference order for income-driven repayment plans applies; PAYE first, followed by IBR or REPAYE, with ICR last.